salt tax cap news

21 hours agoManchins Wednesday statement also said that he supports a 15 corporate minimum tax for the largest US companies. The SALT cap blocks taxpayers from deducting more than 10000 per year in their state and local taxes when itemizing federal deductions.

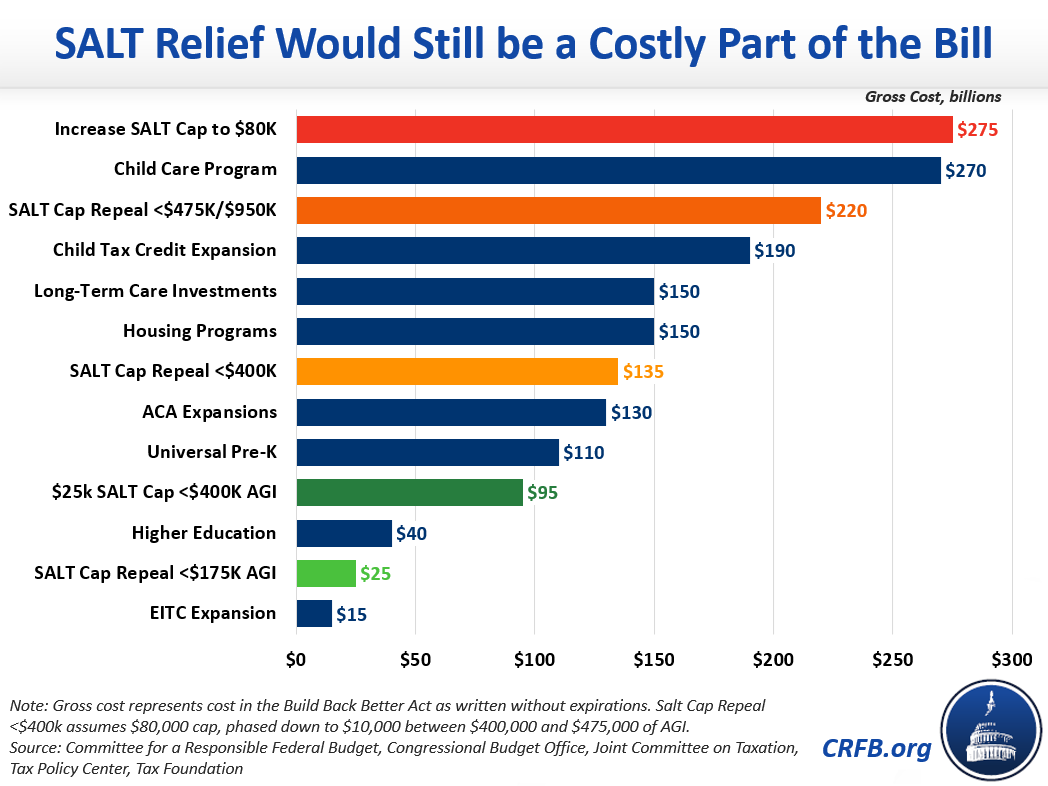

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

In 2017 during the Trump Administration the Tax Cuts and Jobs Act TCJA raised the amount of the standard deduction.

. On July 20 2022. At least hes trying. The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017.

Without an extension from Congress the 10000 SALT cap will automatically sunset in 2026 restoring the full tax break. The Supreme Court declined to review a New York-led constitutional challenge to the 10000 cap on. 2018 analysis showed 752000 Californians earning less than 250000 a year paid an additional 1 billion in federal taxes thanks to the SALT cap.

52 rows The deduction has a cap of 5000 if your filing status is married filing separately. Climate and health care measures also omitted any SALT-cap expansion. By Aysha Bagchi Perry Cooper and Donna Borak.

But the bill contained one very good very progressive provision. Unfortunately House Democrats just made a proposal. 164b6 added by the TCJA for tax years 2018 through 2025 limits the itemized deductions for personal property taxes state or local taxes foreign taxes and state and local sales taxes in lieu of state and local income taxes to 10000 per year 5000 if married filing a separate return the SALT cap.

News April 20 2022 at 1012 AM Share Print. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year. The deduction cap should be fully eliminated but Hill haggling may just raise it to a higher number say 15000 or 20000.

As Fox News reported the House passed legislation last year that would bring the cap up to 80000 until 2031 when it would be limited once again to 10000. To help pay for that increase SALT deductions were capped at 10 000 per. The SALT tax debate isnt going away anytime soon.

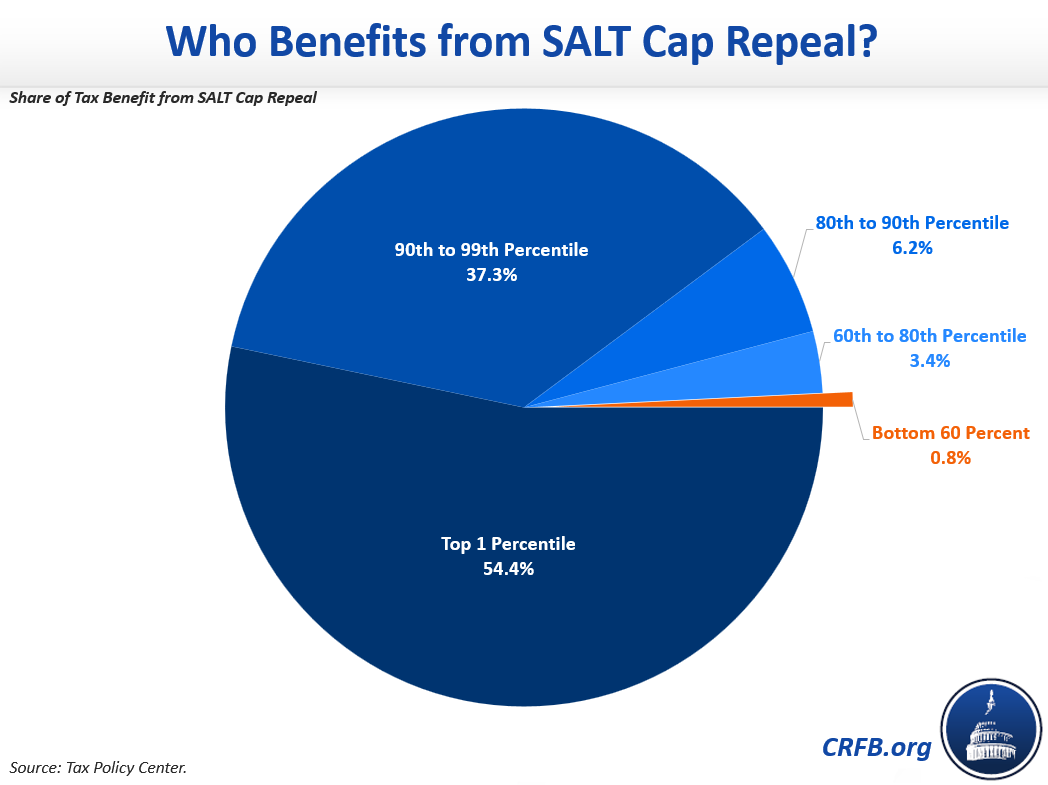

It wasnt until ten paragraphs into the report that NBC News acknowledges the SALT provisions would give two-thirds of people making more than a million dollars a tax cut Ina Coolbrith Park. 7 hours agoExcluding an increase of the 10000 SALT deduction threatens to cause problems with several House Democrats whove said their support of any tax-code changes is. Manchin Backs 369 Billion Energy-Climate Plan Rejects SALT.

Capping the State and Local Tax SALT deduction at 10000 per household. This cap remains unchanged for your 2021 taxes and it will remain the same in 2022 if Congress doesnt remove the cap in its spending bill. But the TCJA imposes a 10000 cap on deductions for SALT payments for 2018 through 2025.

While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over. Because the cap workaround passed so late in this years tax season it allows the businesses. Virginia partnerships and other pass-through businesses will have an extended period to decide whether to take advantage for 2021 of the states new device for cushioning the 10000 federal cap on individual deductions for state and local taxes.

However for tax years 2018 through 2025 the TCJA capped the SALT deduction at 10000 for single taxpayers and couples filing jointly limiting its value for tax filers. Democrats have forged a compromise to. The latest SALT plan would remove the current 10000 cap part of the 2017 tax overhaul entirely for those making less than 400000 a year.

Pass-through business owners in a growing number of states may take advantage of entity-level state tax elections as a measure of relief from the 10000 federal deduction limit for state and local taxesthe SALT cap which was introduced under the 2017 Tax Cuts and Jobs Act or TCJA. Raising the 10000 SALT cap has been a key priority for Senator Bob Menendez. Not in these quarters.

December 12 2021 930 AM 4 min read. As he said Monday about the repeal of the SALT cap If it doesnt happen I will look like an idiot. As a result the percentage of taxpayers claiming the deduction fell by nearly two-thirds while the average amount claimed fell by 80 percent.

Senator Joe Manchin D-WVa on Wednesday said he opposes changes to the state and local tax deduction known as SALT. The trend among states to adopt elective pass-through entity taxes or PTETs. As a result you must stay on your toes to ensure that you can claim the maximum deduction for your situation.

Manchin in Washington DC. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that hit the New York metro area particularly hard. Dave Goldiner New York Daily News 1152021.

The so-called SALT tax cap imposed a 10000 limit on IRS deductions for state and local taxes like income and capital gains levies and property taxes. And while its presently due to sunset in 2025 Suozzi should. Judy Chu D-Calif speaks during a news conference announcing the.

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

Salt Deduction Relief May Be In Peril As Build Back Better Stalls

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Deduction Resources Committee For A Responsible Federal Budget

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Calls To End Salt Deduction Cap Threaten Passage Of Biden S Tax Plan

Tax Me I M From New Jersey Wsj

Why This Tax Provision Puts Democrats In A Tough Place Time

New Salt Proposals Would Improve House Bill Committee For A Responsible Federal Budget

Salt Here S How Lawmakers Could Alter Key Contentious Tax Rule

Repealing The Federal Tax Law S Cap On State And Local Tax Salt Deductions Is No Improvement Itep

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Gaming The Salt Cap May Be Congress S Worst Tax Idea Of The Year

The Latest Salt Cap Fix Would Mostly Benefit High Income Households Do Little For Middle Income People

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Lawmakers Can T Reconcile Weakening The Salt Cap With Progressive Goals The Hill